“Fighting for Peace is like Screwing for Virginity” — George Carlin.

A Must-See Video on Monetary History:

http://hiddensecretsofmoney.com/blog/140-Years-Of-Monetary-History-In-10-Minutes (Yes, there is the fear sale–buy precious metals since the world will end, but look past that to learn about monetary history in an entertaining video. You can also view Mike Mahoney’s other videos.)

The difference between currency and money: http://hiddensecretsofmoney.com/videos/episode-1 (Hint: Money is a store of value.) www.moneyfornothingthemovie.org

Gold: https://www.valcambigold.com/charts.aspx

Things that make you go Hmmmm… ttmygh_26_aug_2013

Whenever a government puts restrictions or controls on a commodity, you buy!

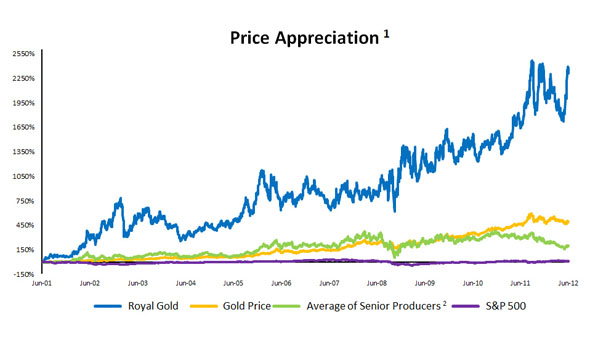

Gold miners: http://denaliguidesummit.blogspot.ca/2013/08/hurricane-surge-for-gold-miners.html

Pzena_Commentary 2Q13 or Value vs. Growth Investors

Pzena_Commentary 2Q13 or Value vs. Growth Investors

RC&G_Investor_Day_2013 Sequoia’s Investor Day

Meet the New Federal Reserve Chairman

Aristotle on Tyrants

Submitted by Simon Black of Sovereign Man blog,

Nearly 2,400 years ago, Aristotle wrote one of the defining works of political philosophy in a book entitled Politics.

It’s still incredibly relevant today, particularly what he writes about tyranny.

The ancient Greeks used the word ‘turannos’, which referred to an illegitimate ruler who governs without regard for the law or interests of the people, often through violent and coercive means.

Aristotle attacks tyrants mercilessly in his book, and clearly spells out the criteria which make a leader tyrannical. You may recognize a few of them:

- Aristotle suggests that a tyrant rises to power by first demonstrating that he is a man of the people:

“He ought to show himself to his subjects in the light, not of a tyrant, but of a steward and a king.”

and

“He should be moderate, not extravagant in his way of life; he should win the notables by companionship, and the multitude by flattery.”

- But once in power, a tyrant uses all available means to hold on to power, including spying on his people:

“A tyrant should also endeavor to know what each of his subjects says or does, and should employ spies . . . and . . . eavesdroppers . . . [T]he fear of informers prevents people from speaking their minds, and if they do, they are more easily found out.”

- Furthermore, Aristotle tells us that a tyrant thrives by creating division and conflict– “to sow quarrels among the citizens; friends should be embroiled with friends, the people with the notables [the rich]. . .”

- Controlling the economy and stealing the citizens’ wealth is also another mark of a tyrant:

“Another practice of tyrants is to multiply taxes. . . [and] impoverish his subjects; he thus provides against the maintenance of a guard by the citizen and the people, having to keep hard at work, are prevented from conspiring.”

- And as Aristotle points out, a tyrant also attempts to disarm the people such that “his subjects shall be incapable of action” because “they will not attempt to overthrow a tyranny, if they are powerless.”

- Naturally, a tyrant “is also fond of making war in order that his subjects may have something to do and be always in want of a leader.”

- Aristotle also tells us that tyrants hunt down those who oppose their power:

“It is characteristic of a tyrant to dislike everyone who has dignity or independence; he wants to be alone in his glory, but anyone who claims a like dignity or asserts his independence encroaches upon his prerogative, and is hated by him as an enemy to his power.”

- Ultimately, though, Aristotle concludes that “No freeman, if he can escape from [tyranny], will endure such a government.”

He’s right. And in the past, people had to rise up in the streets to defeat tyranny.

Fortunately, there are many tactics available to freedom-oriented people today that don’t involve violent revolution.

For rational, thinking people who find themselves living in a state that is rapidly sliding into tyranny, one of the most important steps to take is reducing exposure to that government.

If you live, work, bank, invest, own property, run a business, hold your precious metals, store your digital data (email), etc. all in the same place, you are running some serious ‘sovereign risk’.

In many cases, you can move precious metals overseas, set up a foreign bank account, or create an offshore, encrypted email account with a few mouse clicks.

Take a look back at Aristotle’s points. If the majority of them look familiar, it may be time that you look around the world for alternatives.

US planned war on Syria (What a surprise!)

http://web.archive.org/web/20130129213824/http://www.dailymail.co.uk/news/article-2270219/U-S-planned-launch-chemical-weapon-attack-Syria-blame-Assad.html