James Turk, a Goldbug, giving a speech last month to a mostly empty auditorium in Zurich last month.

Technical analysis versus value in gold By Alasdair Macleod Posted 16 May 2014

At the outset I should declare an interest. In the 1980s I was a member of the UK’s Society of Technical Analysis and for a while I was the society’s examiner and lecturer on Elliott Wave Theory. My proudest moment as a technician was calling the 1987 crash the night before it happened and a new bull market two months later in early December. Before anyone assumes I have a gift for technical analysis, I hasten to add I have also made many wrong calls using it, so to be so spectacularly right on that occasion was almost certainly down to a large element of luck. I should also mention that the most successful investors I have observed over 40 years are those who recognize value and disdain charts altogether.

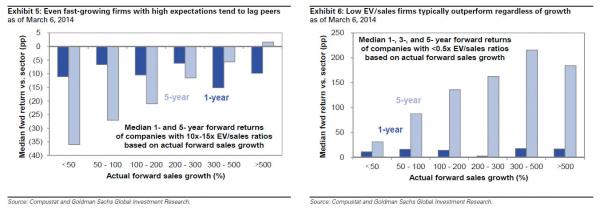

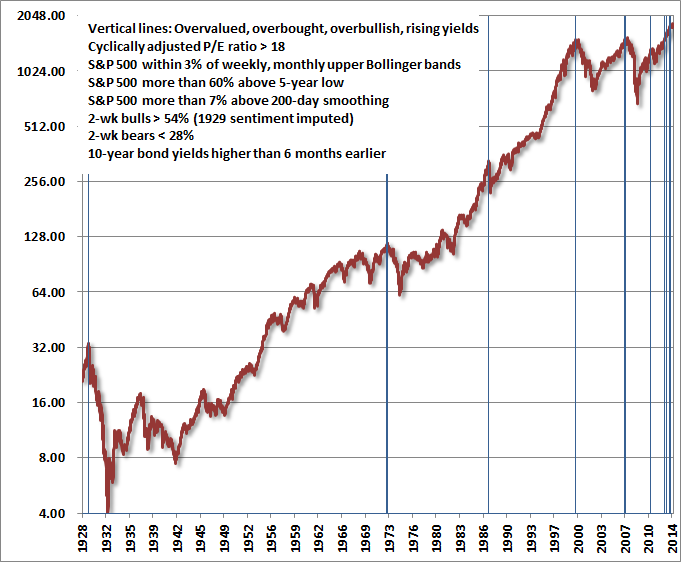

Technical analysts assume past prices are a valid basis for predicting what investors will pay tomorrow. The Warren Buffetts of this world act differently: they care not what others think and use their own judgment of value. This means that value investors often buy when the trend is down and sell when the trend is up, the opposite of technically-driven decisions. A bear market ends when value investors overcome the trend.

Technical analysts go with the crowd and give any trend an added spin. This explains the preoccupation with moving averages, bands, oscillators and momentum. Speculators, who used to be independent thinkers, now depend heavily on technical analysis. This is not to deny that many technicians make a reasonable living: the key is to know when the trend ends, and the difficulty in that decision perhaps explains why technical analysts are not on anyone’s rich list.

Value investors like Buffett rely on an assessment of the income that an investment can generate, and the opportunity-cost of owning it. This may explain his well-known views on gold which for all but a small coterie of central and bullion banks does not generate any income. So where does gold, a sterile asset in Buffett’s eyes stand in all this?

Value investors in gold who buy on falling prices are predominately Asian. For Asians the value in gold comes from the continual debasement of national currencies, a factor rarely considered by western investors who measure investment returns in their home currency with no allowance for changes in purchasing power.

The financial system discourages a more realistic approach, not even according physical gold an investment status. Using technical analysis with the false comfort of stop-losses leads to more profits for market-makers. Furthermore, gold’s replacement as money by unstable national currencies makes economic and investment calculation for anything other than the shortest of timescales unreliable or even impossible. But then this point goes over the heads of the trend-followers as well as the fundamental question of value.

Technical analysis is a tool for idle investors unwilling or unable to understand true value. It dominates price formation in western markets and distorts investor behaviour by exaggerating any natural bias towards trends. It is this band-wagon effect that is the root of trend-following’s success, but also its ultimate weakness. A better strategy is to make the effort to value gold properly and then act accordingly.

http://www.goldmoney.com/research/analysis/technical-analysis-versus-value-in-gold

Longleaf Partners Presentation

http://longleafpartners.com/ (click on video link on the right side)

A great book on good capital allocating CEOs, The Outsiders: http://www.amazon.com/The-Outsiders-Unconventional-Radically-Blueprint/