We are taking up from the last post http://csinvesting.org/2016/07/25/major-analyst-exam-reading-a-proxy-then-assessing-management-and-directors/

This case study teaches us about reading a proxy, management compensation, board governance, and the struggles of activism.

Mr. David Winters of wintergreen_fund_annual_report_2015_1231 has struggled since inception. From inception on 10/17/2005, Wintergreen has returned 68.73% vs. 113.22% for the S&P 500. Another fund started in 12/30/2011 returned 15.95% vs. 77% for the S%P 500. Nevertheless, he has done a service for the investment community by pointing out egregious compensation plans in Wintergreen-TheTerrible10-2-web. Then note the passiveness of the big index funds in terms of protecting their own shareholders, 20150430-Wintergreen-Advisers-BigIndex.

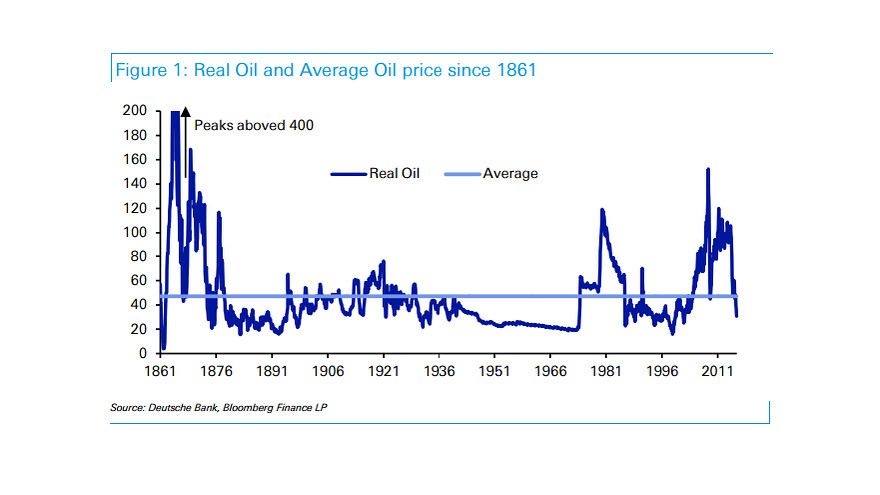

Mr. Winters began his battle with Coke in 2014. KO_VL Jan 2015. Coke has a fine franchise with high returns on capital, but its cost structure (including management’s compensation) may be far too high considering the competitive pressures that incombents are facing. Coke has had to make pricey acquisitions to diversify out of brown sugary fizz drinks. Also, all incumbents are facing new pressures like DollarShaveClub.com breaching of Gillette’s (P&G) moat–see below

—

Dollar Shave Club Hurting Gillette

Video:

Analysis of Dollar Shave Adshttps://www.youtube.com/watch?v=cW8S-QBKcq4

As a review: Mr. Winter’s on Wealth Track: https://youtu.be/x6I1B3MaTms

Ok, back to Coke’s Proxy and Wintergreen’s battle to have Coke’s Board rescind the 2014 incentive compensation plan. See the progression of the battle along with the slide presentations: Wintergreen Faults Coca Cola Management (KEY DOCUMENT TO READ!)

Then view Wintergreen’s presentations along with the articles in the link above:

- Wintergreen_KO_FINAL_Dilution 16 percent_040214

- Firing Coke Workers Will not bring back growth

- Coke Big Grab 2015 Proxy 20150413-WintergreenAdvisers-KO-Report (1)

- 20150413-WintergreenAdvisers-KO-Report

- Coke Revamped Equity Compensation Plan_Wintergreen Advisors

What do you make of Mr. Winter’s struggle? How can you explain Mr. Buffett’s actions? I was DISAPPOINTED but not surprised. What did you learn that would be of help to your investing–the key to anything you spend time on? Note Mr. Winter’s designation of corporate buybacks as another shareholder expense. I believe shareholder buybacks are a use of corporate resources (a shrinking of the equity capital) that may either be a waste or a good use of resources depending upon whether the purchase price of the shares is below intrinsic value. Mr. Winters stresses that buybacks simply use corporate funds to mop up shareholder dilution. Regardless, Mr. Winter points out the huge shifting of shareholder property to a management that hasn’t performed exceptionally well. Coke’s Board had granted exceptional awards for middling performance–now that is a travesty.

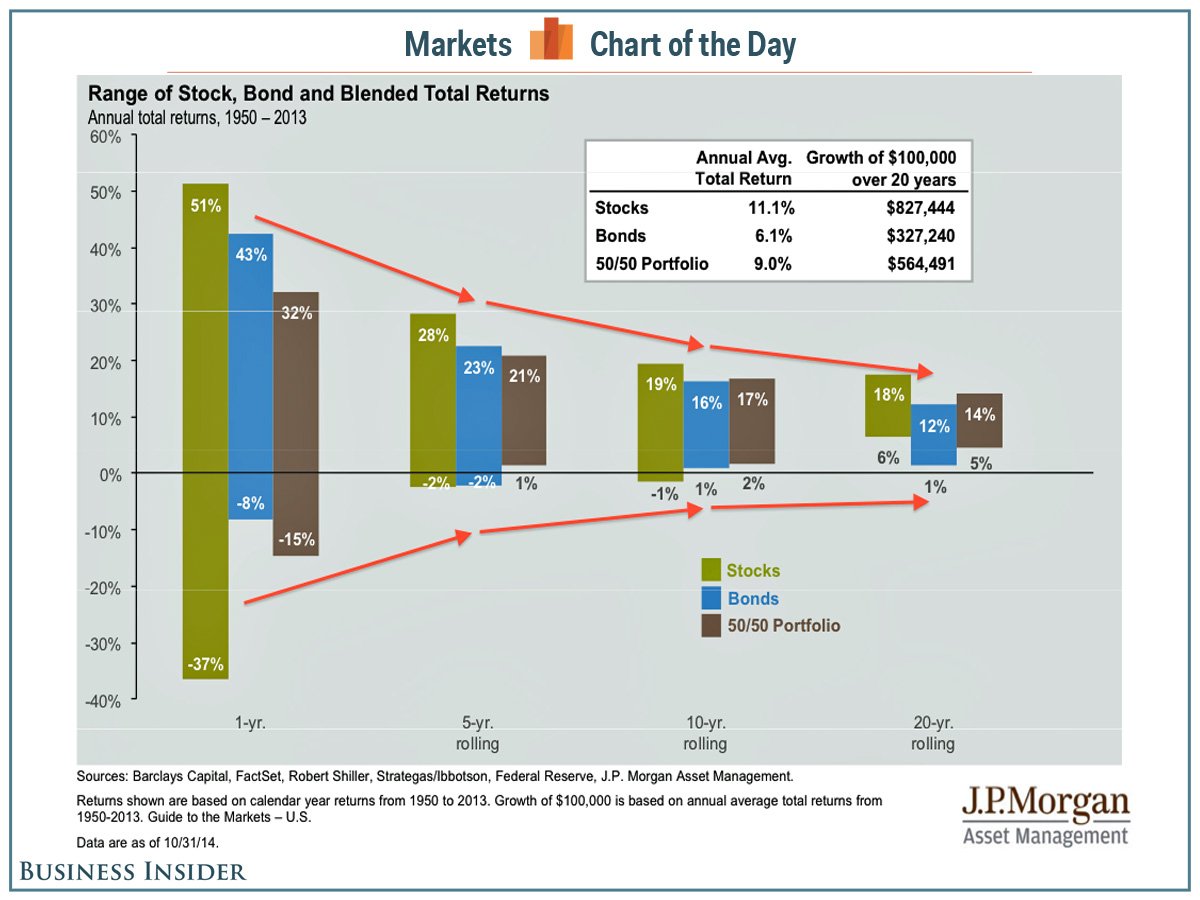

When I think of Coke, a great franchise that is not currently super cheap, I think of other “stable” franchise stocks like Campbell Soup or Kellogg’s. The market has bid these up so your future returns will be low. Do not misunderstand me, these companies are massive, slow-growth franchises, but if you pay too much, then you may have lower future returns for many years.

38630396-An-Open-Letter-to-Warren-Buffett-Kellogg-Company

—-

Lie with statistics http://tsi-blog.com/2016/07/you-can-make-statistics-say-whatever-you-want/

HAVE A GREAT WEEKEND and KEEP DANCING