http://greenbackd.com/2014/04/28/median-stock-at-all-time-high-valuation/ and an interesting look at margins here:

Respecting the Reality of Change

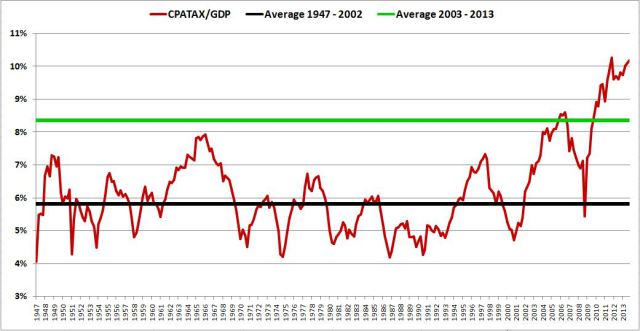

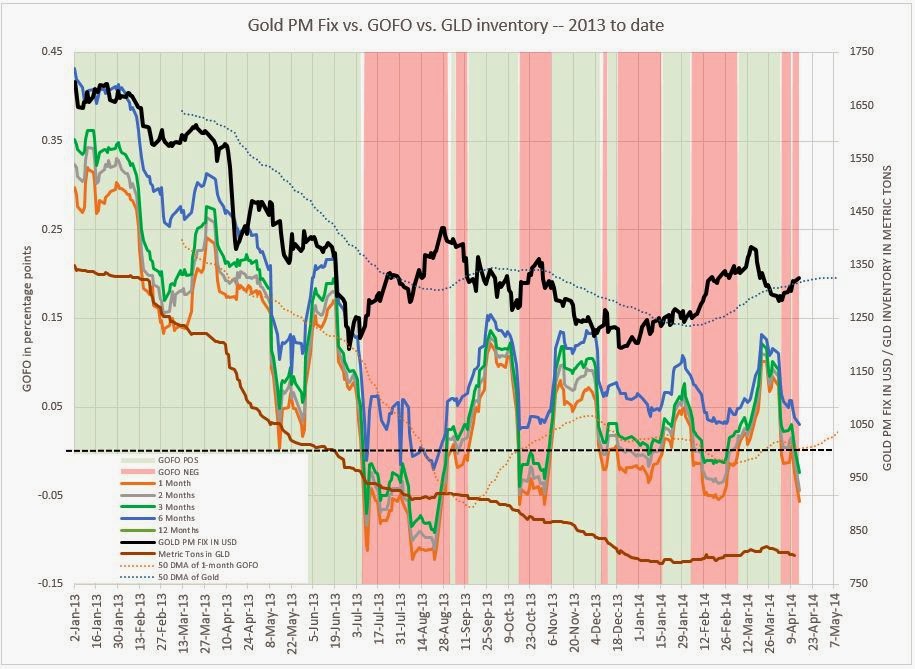

The following chart shows CPATAX divided by GDP from 1947 to present. The black line represents the average from 1947 to 2002, and the green line represents the average from 2003 to 2013.

As you can see in the chart, CPATAX/GDP is wildly elevated at present. It currently sits 63.3% above its average from 1947 to 2013, and a whopping 75.0% above its average from 1947 to 2002.

As readers of this blog have probably inferred by now, I’m not very patient when it comes to waiting for “mean-reversion” to occur. In my view, when a variable deviates for long periods of time from a reversion pattern that it has exhibited in the past, the right response is to expect something important to have changed–possibly for the long haul, such that a predictable reversion to prior averages will no longer be readily in the cards. The task would then be to find out what that something is, and try to understand it. Go here:

| http://philosophicaleconomics.wordpress.com/ |

| http://www.millennialinvest.com/ (Interesting blog) |

Reader Question:

Can you help me understand one aspect of ROE? In Indian companies, some of the companies have ROE < ROCE.

Isn’t that a violation of the observation that ROE ~ ROCE times Leverage.

I define ROCE as Return on Capital Employed.

ROCE = EBITDA (1-Tax Rate)/Total Capital Employed (=Debt+Equity)

I use ROCE as a measure of the attractiveness of the industry and the company. High ROCE is good, implying a moat, low ROCE is not.

Some of the reasons I could think of are:

- Exceptional losses, which lead to Net Income << EBIT(1-Tax) *Leverage

- Extremely high interest charges. ( higher than return on the debt portion) which leads Net Income << EBIT(1-Tax)* Leverage

- There is a slump sale of a division, and thus suddenly huge amount of profit has come in increasing inordinately the average shareholder equity. So suddenly the effective leverage has dropped.

Update May 1:

Does someone want to have a crack at this? I see issues whenever you use EBITDA without understanding maintenance capex. Please read this: Placing EBITDA into Perspective

More on WMT: A reader posted this in the comment section: http://www.fool.com/investing/general/2014/04/28/why-is-wal-mart-failing-in-emerging-markets.aspx. Does that article even touch upon the ture nature of WMT’s competitive advantage? No wonder the obvious is overlooked.