This makes an interesting psychological study. Who holds the stock and how they react. ($CMG last at $278, down 14.5%) Many conversations below show no interest in discussing the valuation of CMG, but just the price (and if the price is declining, the pitiful management).

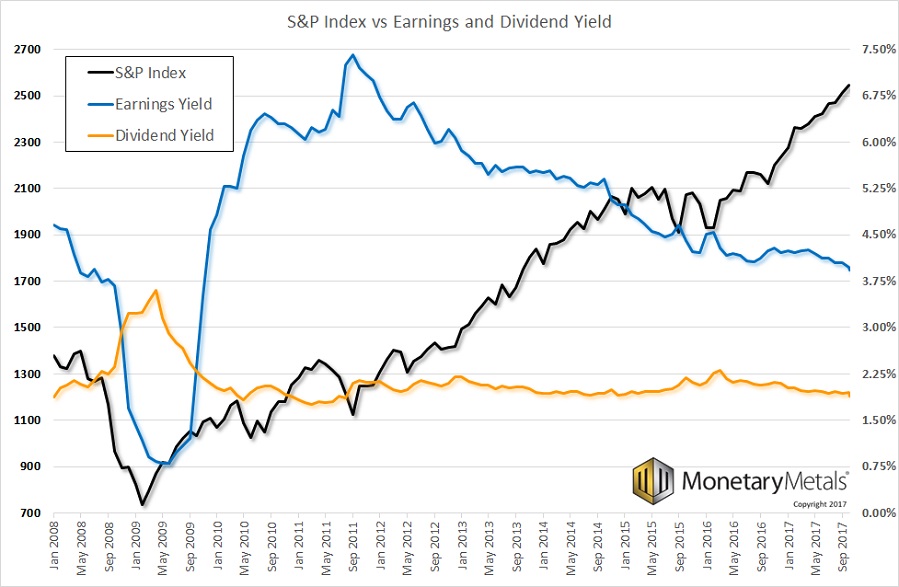

Also, note the focus on P/E ratio for valuation. What about the flaws in using P/Es as a valuation metric? No discussion about the business, cash flows or discount rate.

CMG will probably trade north of 6 million shares today or about 20% of the 28.5 million outstanding shares. Where are the long-term shareholders? One in five investors will sell based on one quarterly report.

If you have done your homework on valuation, then unreflective sellers who are throwing in the towel may mean an attractive price over the next few weeks.

I don’t know much about Chipotle, but management should be able to right the ship OVER TIME–the next 24 months–not next quarter. I don’t own any CMG currently.

Time to pile on (rats falling from the ceiling!): https://www.bloomberg.com/news/articles/2017-10-25/ackman-s-lost-a-lot-of-queso-on-his-stake-in-chipotle

An interesting article on the struggle within the turnaround efforts.

“Every chain restaurant, he says, goes through this rite of passage. For every success like Starbucks, there are former high-flyers like Baja Fresh and Boston Market that no longer have cultural currency and are slowly fading.

Moran (Chipotle founder) remains confident that Chipotle will not end up an afterthought dotting the strip malls of America, but he preaches patience. “Will we climb out of it and get back to our former greatness? I absolutely believe we will,” he told me in June. “But will that take a year or two or three or four? I don’t know. The full recovery from this is going to take a long time.” https://www.fastcompany.com/3064068/chipotle-eats-itself

-

AlabamaHobo

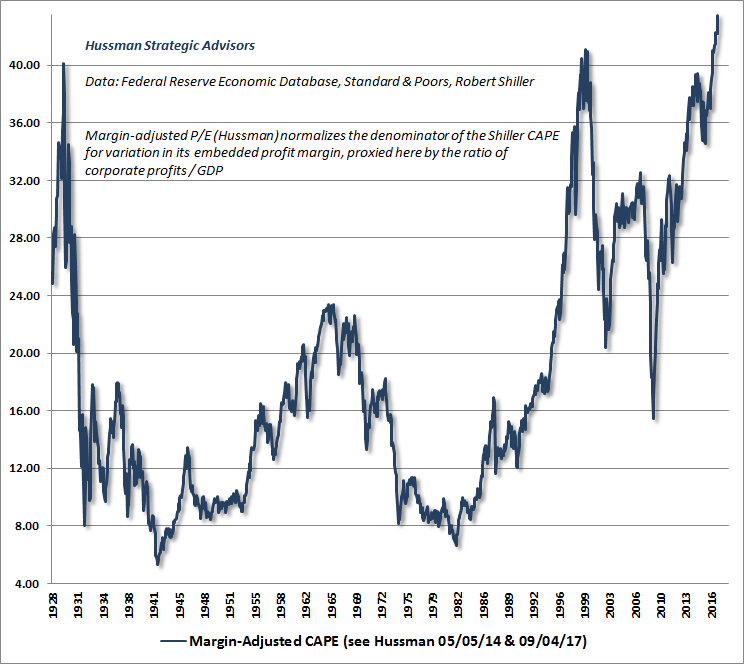

Why does a burrito company trades for 70 PE.

Lots of room all the way down to 15 PE.

DowPete yesterdayAckman has been unusually quiet about his position in Shipotle. For someone who is forever whining, the silence is golden. Glad he’s underwater in $CMG.

DowPete yesterdayAckman has been unusually quiet about his position in Shipotle. For someone who is forever whining, the silence is golden. Glad he’s underwater in $CMG. Mad

Mad13 hours ago

200$ may not be that impossible tomorrow or later. CowboyFan

CowboyFan13 hours ago

Overvalued stock , for a burrito company. -

CowboyFan

CowboyFan14 hours ago

What a POS! Seriously , this is a $40 stock -

BB

BB16 hours ago

Why does almost every retail restaurant or fast food chain trade at 15-25xs earnings and Chipotle get to trade at >60xs? Its still way overpriced, should be $100/share or less. Concept is easily duplicatable and has been many times now. Theres plenty of fast food burrito places out there now.. Tenley

Tenley10 hours ago

I want a refund on my burrito. It taste weird… -

DaveR

DaveR20 hours ago

Even a lemonade stand could beat the latest benchmark for CMG earnings. If they miss this bunny forget about it. -

Jh

Jh14 hours ago

Fair market value $50 -

joe

joe16 hours ago

Hundreds of high school students chow down at these restaurants every day. Me too -

liberal

liberal1 hour ago

I’m loving this fall, hope it goes on through the day and we see 270s today. Make some mulla on those put options from yesterday -

CT

CT4 hours ago

The battle line is drawn at $295 ps. Buyers must buy at this previously held level – otherwise, it is abandoned and a new lower strength level is found. But holding this level will be difficult as it represents a triple bottom.

My bet is that the shares go lower. Once the dam at $295 is broken, the selling will accelerate and we may end up the day at -20%.

-

Jerome R

Jerome R23 hours ago

20% short interest on a 25 mill float, see you at $400 after ER -

Jerome R

Jerome R23 hours ago

20% short interest on a 25 mill float, see you at $400 after ER -

S.P.

S.P.17 hours ago

Owning this stock is like having CMG’s molten cheese poured on -

george

george20 hours ago

Bloodbath coming after hours. The bombs start decimating your portfolio at 4:30 PM. Get your shovel out to dig your own grave. Just jump in, we’ll kick some dirt on top of you. -

Mocula

Mocula13 hours ago

What was the total compensation for the CEO this year? The small amount of money I lost on this stock, means nothing to the officers. As long as they car drive a fancy car or pay a lot for a douchebag haircut, they will just continue to make excuses and take as much as they can. -

Robert

Robert15 hours ago

Jerome, Hope you didn’t get killed too bad. This stock is a pig. Over priced. Should see $250 in a week. Cannot beat same stores off a week quarter to comp. McDonald’s had stores close in Houston and Florida. Face it. Bad food, overpriced, competition. The shorts won’t cover until $275.00. -

WIZARD1973

WIZARD197316 hours ago

I can’t believe they think remodeling the restaurants and raising prices are going to bring people back. I hope they have a better plan than that!’-

Bay Area

8 hours ago

This burrito seller is still trading at insanely high PE. Fools find 300 cheap because they are comparing with the peak of 2015. That was a pure scam by Kramer type people. Giving the mess and slumped earnings, risky low margin business, very specific narrow menu, this stock should be trading at no more than PE =10 -

Ahh Haa

Ahh Haa19 hours ago

About to be Bill Ackholed. -

Andre

Andre12 hours ago

I’m hoping this dips sub $290ish for a quick trade. The most brutal selloff periods are in the first hour of trading. Don’t fall in love with a position whether long or short. Volatility in any stock makes it great to spot a trend and make a great trade. -

kevin

kevin39 minutes ago

Spoiled foods. Empty stores. Flopping queso. Run and sell!!!

-