Amazon’s Business Is ‘Disappearing,’ Columbia’s Greenwald Says

December 1, 2011 — 11:25 AM EST

http://www.bloomberg.com/news/articles/2011-12-01/amazon-s-business-is-disappearing-columbia-s-greenwald-says

Amazon.com Inc. shares are overvalued because its core business of selling books and music online is “disappearing” and it’s competing with larger rival Apple Inc. in tablet devices, according to Columbia University’s Bruce C. Greenwald.

“Amazon trading at 100 times earnings is almost a joke,” Greenwald, a professor of management and asset management at the New York-based university, said today at the Bloomberg Hedge Fund Conference hosted by Bloomberg Link. “If Amazon doesn’t deliver profitability in the long run, it’s not going to stay at 100 times earnings.”

Amazon, based in Seattle, trades at 103 times reported earnings for the past year, down from this year’s peak of 129.8 in October, according to data compiled by Bloomberg. The company’s shares gained 2.5 percent to $197.16 in New York trading, and have climbed 9.4 percent this year.

==

By Brendan Byrnes | More Articles

January 4, 2013 |

Bruce Greenwald: Now, Amazon I think is completely different. I think, if Apple is a current profit machine, Amazon is trading on vapors. [laughs]

They make no reported profit; the whole story is a growth story. They’re buying customers on the theory, presumably, that those customers are going to be profitable in the future. Now, for customers to be profitable you have to dominate segments.

The segment that Amazon has traditionally dominated is, of course, books, music, and video. Well, we know what happened to the music business when it went digital, which is the profit vanished and even Apple doesn’t make any money on iTunes.

The same thing is happening to books, with the connivance, by the way, of Amazon. The same thing is happening to video, so their core business is dying. The business that they dominated, where they made all their money, is dying.

What have they decided to do? Go into a lot of businesses where they have no competitive advantage. First they’ve gone into every variety of retail: TV sets against Wal-Mart and Best Buy, who have better distribution economics…

They can buy the business, but in the long run, unless they can get bigger share than those companies, their pricing is going to be at a disadvantage to those companies, because those companies can distribute the TVs and other devices more cheaply.

Then what did they decide? They said, “Oh, that wasn’t a big enough challenge. Let’s go after the Oracles and the IBMs and all the companies that do cloud computing, and the SAPs and so on, and the Googles,” and they went into that business.

Now, if you think they’ve got a competitive advantage in that business while they’re going after everybody in retail, lots of luck. But then they decided that was not enough, so they decided to go after Apple and the others in the device business.

This looks, to me, like a company that makes no reported profit, which I think is fair, that’s trying to buy growth in all sorts of areas where, because it has no competitive advantage, the growth is going to be value-destroying, not value-creating.

http://www.fool.com/investing/general/2013/01/04/bruce-greenwald-amazon-is-trading-on-vapors.aspx

—

Amazon launched its first smartphone last week – the Amazon Fire phone.

It doesn’t represent any sort of leap forward in smartphone technology, according to reviews. So it probably won’t take a huge amount of market share from Apple or Samsung/Google.

Meanwhile, both Apple and Google are eating into one of Amazon’s traditional core businesses, selling music and video content.

So is Amazon’s new smartphone just a desperate bid to preserve market share? Or is it another ballsy, far-sighted move by Amazon’s boss, Jeff Bezos – one that will pay off in the end?

I think it’s the latter. And that’s why I’m willing to hang on to my Amazon shares – even although they trade on an eye-watering price/earnings ratio (P/E) of 500.

You might think I’m mad – but let me try to persuade you otherwise…

What’s Amazon’s new phone like?

I’ve not seen one of Amazon’s phones, but it sounds like they’re pretty similar to your average iPhone, but with two fresh add-ons.

One is a semi-3D capability that has been greeted with a ‘meh’ reaction by most reviewers. In truth, I don’t really understand how this 3D function works – I’ll have to wait and see a phone before I can do that.

The other improvement is a ‘recognition engine’ which has been received much more warmly. It’s called Firefly and is a sort of audiovisual search tool. It recognises books, various consumer goods, music, video and more. And once the phone has recognised the item, you can immediately put it in your Amazon shopping basket.

“Not only was it effective”, says Gizmodo, “it was kind of beautiful”.

So it’s pretty obvious that Amazon is launching the phone in an effort to sell more stuff. Purchasers of the phone will also get a year’s free membership of Amazon Prime, which normally costs £79.

Prime offers free delivery on many purchases, the opportunity to ‘borrow’ books to read on your Kindle, and access to a wide selection of video titles. Amazon says that Prime customers spend four times as much on Amazon as other users, and that half of Amazon’s sales are to Prime customers.

So if the Fire phone can significantly boost the number of Prime customers, it will probably prove to be a savvy move by Bezos.

Now, not everyone is convinced that the phone launch is a smart move.

For example, Bruce Greenwald, a finance professor at Columbia Business School, made some negative comments to the Guardian. “This sequence of crazy initiatives in areas where they have no competitive advantage is about sustaining an unsustainable stock price… Amazon owns the books market, but what is happening to the value of that monopoly? They have a core business in which they are dominant, it’s going away and they are thrashing around trying to justify their $150bn market capitalisation.”

Is Greenwald right? I don’t think so.

Yes, Amazon faces growing competition. In digital content, it is competing with Apple, Google, music streaming service Spotify, and many others.

And on the physical consumer goods side – in other words, items that are delivered from its warehouses rather than online – the likes of Tesco, Argos and Walmart are all growing smarter about online retail. These chains also benefit from owning large store networks which are useful for customers who like to “click and collect.” Amazon isn’t so well placed for ‘click and collect.’

Greenwald is also right to highlight Amazon’s high valuation. However, I believe that valuation can be justified and that’s why I’m happy to hang onto my shares.

Why Amazon’s ‘crazy’ share rating is justified

No other online retailer offers such a large variety of products for sale. And Amazon is still growing its sales faster than the growth rate for overall e-commerce around the world. Last year, Amazon was the ninth-largest retailer in the world. Consultancy Kantar expects it to be the second-largest by 2018.

Amazon’s network of warehouses is also a very useful asset. It has 106 ‘fulfilment centres’ around the world, of which ten are in the UK. It is also trying to improve its ‘click and collect’ capacity by offering collection points at some London Underground stations.

Amazon also has a great record of investing for the long term. When Amazon launched Amazon Web Services in 2005, many observers doubted that the company could become a major player in this field – providing services to businesses. But, according to The Motley Fool, it now controls more than 30% of infrastructure for the ‘cloud’.

The point is, there will come a time when Amazon can afford to slow down the pace of growth and allow its profits to rise dramatically. When that happens, today’s valuation won’t look so crazy.

I’ll freely admit that Amazon is probably the highest-risk stock in my portfolio, but I’m happy to hold for further growth to come. And the Fire phone will play its part in achieving that growth.

—

So what do YOU think? How would you value Amazon? What major adjustment would you need to make? What is the business trying to do?

If you need a hint: http://ben-evans.com/benedictevans/2014/9/4/why-amazon-has-no-profits-and-why-it-works

Does anyone want to bet $200 that Prof Greenwald will NEVER admit he might have miscalculated or misunderstood Amazon’s business?

What if he read their annual report: amazon-shareholderletter97

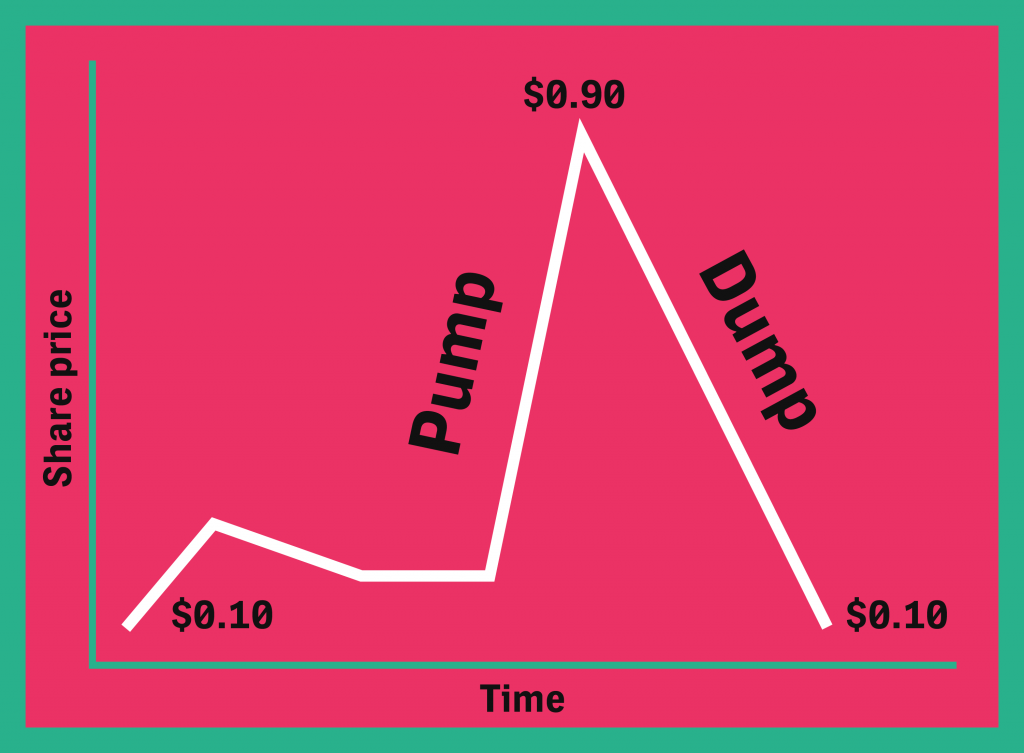

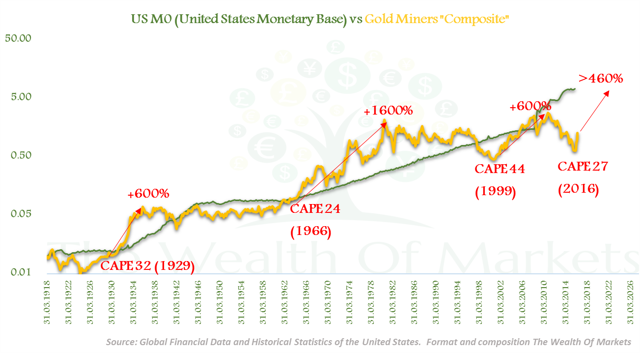

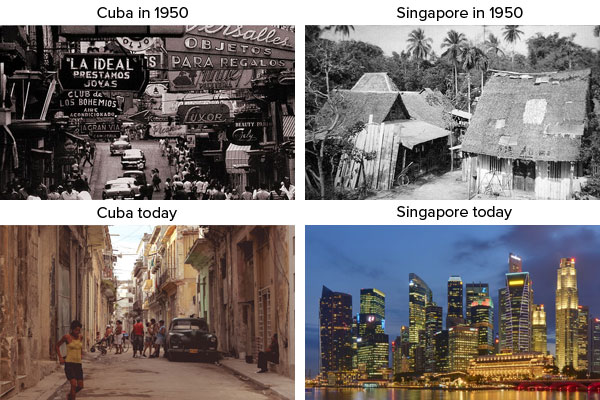

What caused the above?