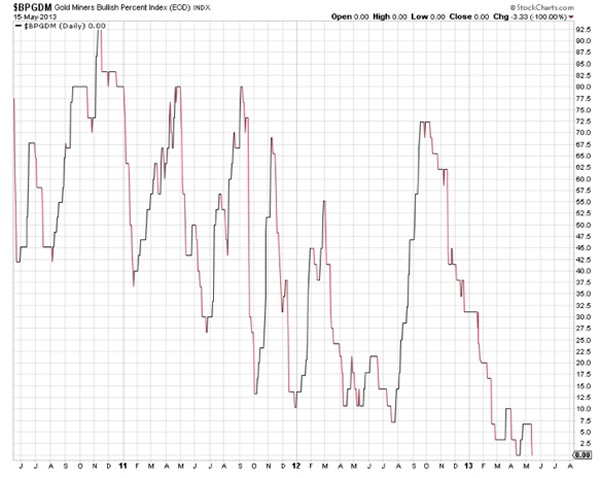

Value Around the World (Blue is neglected/Red is popular)

Career Advice

A readers asks:

As a brief background, I’ve been extremely interested in value investing since 2008. I decided to make a career switch (from media to finance), and so got an MBA, after which I joined the sell side, covering consumer staples for a great senior analyst in XXXX. My goal was to learn how to do value added in depth research (as well as modeling etc.), and then move to asset management and investing down the line. At this point (I’m 28), I’ve been doing this for 2 years, and have 2 offers on the table.

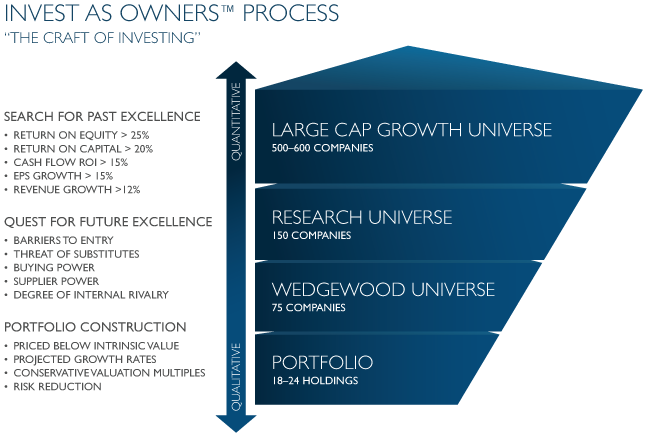

The first is for a very small fund, which is run by two portfolio managers. They have a concentrated (xx positions) strategy, and focus on buying quality companies with sustainable ROIC at fair prices. They also try to maintain a circle of competence, and only look at a few sectors. They’ve been operating for 8 years, and have outperformed their benchmark by 8% annually, with a sharp ratio below 1. My feeling was that both managers were very intelligent, and I could learn a huge amount from them (one has a finance background and asset management experience, and the other is a strategic thinker that has more industrial experience at some very high quality businesses). It seems like a risk, but also potentially a great opportunity to do what I want.

The second offer is to join one of the big bulge bracket banks in XXXX in Equity Research, as a senior associate covering a consumer sector, with a seemingly high quality analyst (top 5 ranking). I would maintain sector coverage whilst the senior analyst is away. So it’s a big increase in responsibility and quite a good opportunity to prove myself at a quality firm. My feeling is that I could continue to learn, enhance my circle of competence, and whilst not doing exactly what I want right away, I still very much enjoy analyzing companies, and it may give me better opportunities afterwards.

What type of advice would you have in this situation, and how would you approach it?

My advice: Other intelligent readers can lend their tenor to your question since I will give you my biased opinion. I think you answered your own question.

Go work for the smaller, more entrepreneurial firm doing what you want to do NOW.

You are simply moving laterally if you join the big firm to work for the female consumer products analyst. What great leap are you making there? If your goal is to become a value investor, then you probably don’t want to work for a sell-side firm. Your job would be to push stocks or deals.

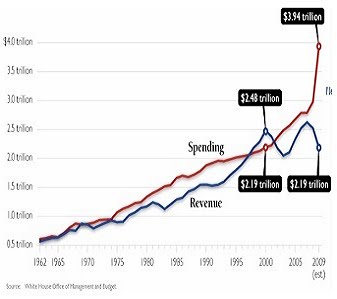

Also, while young, be willing to fail. If you join the smaller firm there is more room to contribute meaningfully and to learn. What is the worse than can happen? You have two experienced investors who are pursuing a market beating approach–focused investing within their circle of competence. Also, you will be learning other industries. You can learn from two minds instead of one. Big brokerage houses are rife with conventional thinking. Also, the consumer products industry (in general) right now is about as overvalued as I have seen in years so the timing wouldn’t be pretty. Would your bulge bracket firm allow you to put out sell or short recommendations on grossly overpriced companies? I doubt it.

The risk is if the small firm has the wrong approach (short-term trading) with individuals who do not follow consistently a sensible strategy. Based on what you say that is not the case.

I sense the big bulge bracket firm is more of a security blanket than an opportunity. Go for doing what you want now since life is short.

Good luck