I have recently received many suggestions to improve this course. There are almost 600 people in our group with many different backgrounds and experiences. There may be advanced students who wish to discuss current case studies (Why is DLX, Deluxe, not a value trap like Radio Shack?) or potential investments or subjects into greater depth. This course planned to follow Deep Value (book) while digging deeper into the footnotes without preconceived notions. If, for example, we read about Buffett’s transition from net/nets to franchises, we will look at franchises but not focus on them. The point is to give students background to understand the distinctions. However, this may be too basic for many of you.

My goal is to make this a learning community. One idea would be to set up another blog (volunteers?) to discuss various ideas if there is enough interest. I won’t give out anybody’s email without their permission, but if a group of students wanted to dig deeper into various subjects, I am happy to provide a link to this new group or discussion area. I will wait until I hear your feedback.

For example, a reader/student went into vast effort to provide feedback and suggestions. Dr. K (my nickname for this reader) might be an excellent leader to develop a new discussion blog? Below are Dr. K’s emails and links. I will post your suggestions.

EMAIL 1

John; This is Dr. K following up from our phone conversation. So far I am very frustrated with the deep value course and in the following series of emails I will explain why.

Why I hate mechanical investing and problems with back-testing

- First of all Seth Klarman in his book (Intro xvi, p.13, p.16-18, p.151, p.162) discusses the folly of searching for the holy grail “mechanical” formula for investing success. BG in The Intelligent Investor p.38-46 and p.194-195 also says mechanical formula investing is self-defeating. It contradictory that we are reading about mechanical formula (Toby Carlisle’s books). Mechanical formula (Toby Carlisle and Joel Greenblatt’s 2nd book) come off as lazy, naïve, and immature to me.

- Seth also is not a fan of Wide Moats (see p.32-34, p.93) but I guess that’s OK but it’s very confusing how we are jumping around from one investment ideology to another!! Seth also does not think much of EBITA (see p.71-78) while you seem to mention it on the front of your blog home page in a link at the top.

- Now go to http://falkenblog.blogspot.com and read as many past articles as you can. You should also get his first book: “Finding Alpha.” There is no need to read the rest of his books. In that book especially key in on p.115-116 “Geometric vs. Arithmetic Averaging”, p.116-117 “Survivorship Bias”, Ch. 6 p. 113-125 “Is the Equity Risk Premium Zero?” especially read p.121-123 “Transaction Costs” , p.47 “the Size Effect” and p.48 “Delisting bias.” These are just some of the many reasons why mechanical back testing is a dead-end path to investing success.

- And/or you can go to http://www.efalken.com and watch the Finding Alpha videos. This should take 8 hours but it’s good if you are short on time or you can do both. I also have many of the papers he has written or mentioned. I can send them to you upon request.

- Next go to www.davidhbailey.com.Click on the Mathematical Investor blog and read all of the articles. Now see that attached papers he wrote along with Campbell Harvey.

- Go to www.numeraire.com and read all of the links at the top. In the search site map section click on the article about why screening is not valuation.

- Now go to www.numeraire.com/download.htm . Read every article in the Research Related Letter section. These are short but notice whom he is critical of. Now read all of the articles in the Research Notes section. Especially read “What is Circular Reasoning” which will explain why most stock screens and mechanical formulas (Toby Carlisle, Joel Greenblatt) are garbage! Make sure you click on or go to all of the links in this article. Notice the lists of various forms of logical errors. Notice the cross correlation with behavioral finance! These logical error list need to be studied in greater detail!! Also especially read “What is Economic Simultaneity?”, “A History of the Size Effect” and notice that on p.4-5 he lists some of the variables that are and are not circular!!, “Evolution of Stock Picking”, “Visual Detection of Circular Reasoning” (it’s vital you understand this) and finally “Fatal Summary.” (it’s vital you understand this also) Read all of the articles in Research Presentations and in Research papers (especially “Circling the Square” and notice on p.8 he gives the return formula and it’s vital you understand this).

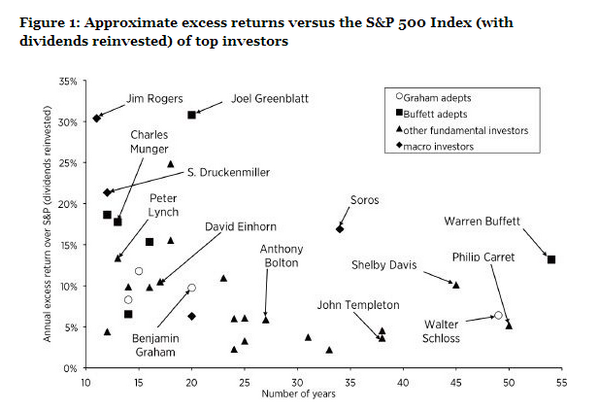

You should a somewhat better idea of why mechanical investing is not scientific. You should not trust academic research as well as a lot of p-side research! I am not impressed with Toby Carlisle and Joel Greenblatt’s second book. I have a good feeling that many people in this course and google group are more advanced then you are aware of and feel the same way. I can tell you that I have been reading many academic papers over the years and would attach them when I tried to apply for a research job and never got any positive feedback from attaching them!! In addition Alpha Titans such as Seth Klarman, Peter Lynch, Warren Buffett, Ben Graham were not fan of this type of investing approach.

Let me know when you have read this stuff. I think you need to read and understand them otherwise you are not fully grasping how difficult value investing really is!! Keep in mind I don’t fully understand everything in this material but I know enough to not be impressed by mechanical investing research garbage studies!!

Most Factor Models that Explain Returns are False _ 1

Anamolies Don’t Do as Well after Publication

A Skeptical Appraisel of Asset-Pricing Tests _ 3

Significance Testing Issues for Empirical Finance 5

The Probability of Backtest Overfitting 6

Factor models to sensative to the time period tested 7

Email #2 about Net Nets.

You mentioned www.oldschoolvalue.comon your site in the resource section. I like this site for the free screens and the blog articles which do a good job of teaching quality investment theory. I am not too fond of his software program and he raised the price and his spreadsheets do not include critical off-balance sheet accounting adjustments (I will explain the New Constructs platform in a later email). Jae Jun thinks his spreadsheet program is better than it really is. (in my opinion).

Go to the -VeEV, NNWC and NCAV screens. Some of the stocks duplicate themselves. Now go to Ben Graham Net Net Stocks and a 7 Step Checklist to Make Money with Net Nets . Notice on p.7 Jae says 99% of Net Nets are useless and on p.9 he does not like Chinese ADRs. I think he also does no include financial companies, REITs, CEFs, Shells etc.

Now go to www.grahaminvestor.com.In the screens link at the top go to the NCAV Stocks (Shares Outstanding) screen. Notice it does include Shell companies and Chinese ADRs but only companies listed in the USA. (no Japanese, Canada, Australia, etc.) The next screen is NCAV Stocks (Float). I am not sure what the advantage of this screen is. It only seems to leverage the Current ratio. I have never seen anyone else mention using Float instead of Shares Outstanding instead. This site also gives: NCAV Stocks (Shares Outstanding, new) and NCAV Stocks (Shares Outstanding, new, no Chinese). I sent an email to the people that run this site about the screens but they never got back to me. I would not blindly trust that these companies are true Net Nets. You should verify the numbers yourself.

Go to http://www.netnethunter.com/my-ncav-investment-scorecard/. Does this guy give you the impression that he is a fan of running a mechanical screen and blindly following it?? Notice that he does analysis on the company’s “Burn rate.” Where did Toby Carlisle mention this?? Make sure you read all of the articles.

Now for the subscription. He does screens for Japan, Australia, Canada. The Japanese financials he gets are written in Japanese and gets the aggregated data from Business week.

A good assignment would be to figure out where for free or how you can screen for Japan, Australia, Canada or anywhere else other than the USA. Given the above two mentioned sites we could also for a day analyze (or for a week) every company of the list in greater detail and not do stupid mechanical investing like it has been suggested so far!!

I think I read that www.gurufocus.com has some Net-Net screens for a subscription rate but I don’t know if they are any good or not.

Another reason why Net Net studies and papers are flawed is that they don’t account for Survivorship bias and delisting bias in the historical database the study was conducted from. It’s quite possible that a company could be a “quality Net-Net” from financial standpoint but if the trading volume is too low then the NYSE could delist the company and then the stock loses 90% of its value as it goes from being a listed company to an unlisted (or OTC) company. Most of the deep value research does not discuss how to account for this and how to follow and trade these OTC companies!!

Here is email #3 about Wide Moat Investing.

You mentioned Pat Dorsey and his books. (see The Five Rules for Successful Stock Investing and The Little Book that Builds Wealth).

- I met Pat Dorsey at a CFA Rochester, NY meeting while he was working for Morningstar. Morningstar has The Stock Investor newsletter which gives coverage of about 150 companies Morningstar believes are “Wide Moat” companies.

- You mentioned Bruce Greenwald’s book and presentations about this subject.

- Now go to www.oldschoolvalue.com/blog/tutorial/this-is-how-buffett-interprets-financial-statements. This is a good summary article of the book “Warren Buffett and the Interpretation of Financial Statements” by Mary Buffett and David Clark. The authors also wrote “Buffettology” and a workbook about this book.

- Also see What Gross Margins Can Tell You About a Company’s Economic Moat by Old School Value.

The assignment here is using these various books, articles and presentations someone subscribe to Morningstar’s Stock Investor newsletter, tell us the list of the 150 companies Morningstar list for “Wide Moats.” Then once we have this list we all go through each company and analyze and verify why these companies are indeed “Wide Moat” companies. In a presentation that you posted recently by WB he mentioned that there are no “Wide Moat” companies in Japan. I suppose we could locate “Wide Moat” companies in countries outside of the USA.

—–

This is email #4 about Special Situation investing. You mentioned Seth Klarman’s book. In the second half of that book he gives various “Special Situation” opportunities. Joel Greenblatt’s first book also was pretty good (but now a little out of date while his second book was a bunch of mechanical garbage).

Email #5 about “Expectations Investing.”

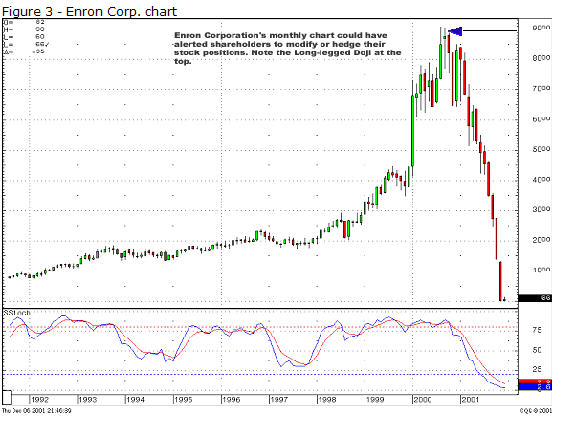

- Go to www.expectationsinvesting.com. Make sure you read “Expectations Investing (2000)” by Alfred Rappaport and Mchael J. Mauboussin and “Creating Shareholder Value (1998)” by Alfred Rappaport. THESE ARE THE ABSOLUTE TWO BEST BOOKS I HAVE READ THAT CLEARLY EXPLAINED WHY CONVENTIONAL ACCOUNTING IS FLAWED AND THE DIFFERENCE BETWEEN ACCOUNTING VALUE AND ECONOMIC VALUE CREATION!! I can’t go into two much detail here but make sure you read and understand every Tutorial on the site!! In a recent post your blog about Enron I think you were trying to highlight the concept of Incremental Capital expenditure. This and Incremental Working Capital expenditure are clearly taught in these two books. These books also do a wonderful job of explaining the underlying drivers of Economic Value creation! You want to understand these spreadsheets in detail!

The assignment here is that New Constructs (See links below) does about 22 various off-balance sheet adjustments. Learn these adjustments and modify the Expectation Investing sample spreadsheets. Know how to do this for companies that New Constructs does not cover. (such as REITs, MLPs, Net Nets, Special Situations, Japan and non-USA stocks). In the case of non-USA companies the accounting conventions would need to be researched.

I think these spreadsheets do such a good teaching job of explaining things!!

(Not posted here-I couldn’t open the zip file)

- Michael’s 2nd book “More then you know” and his 3rd book “Think Twice” are gems that do a good job of summarizing what is going on in behavioral finance and must be read. I have many of the papers he mentioned from these books.

The-Best-Primer-to-Valuation-Multiples Part 2

Financial Ratioswheres the bar ROIC

Decoding Wall Street Propaganda ( A MUST READ!)

Do Investors see through Reported Earnings

Free-Sample-Company-Research-Report-HLS-2013-02-01

END