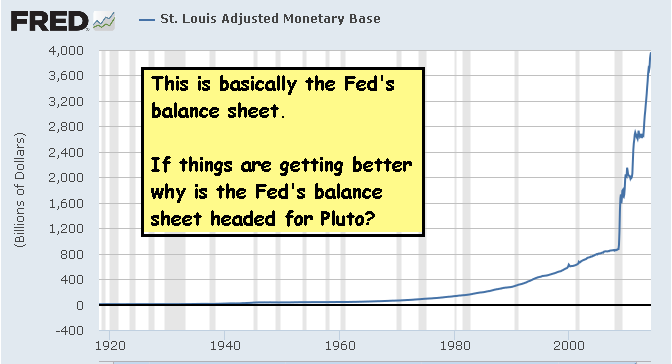

Monetizing Government Debt

In the nineteenth century, the monetary theorist and gold standard advocate Henry Dunning MacLeod, graphically drew attention to the similarity between Law’s plan and the standard practice of the Bank of England (and of modern central banks) of ‘monetizing government debt.” With reference to the latter procedure, MacLeod wrote:

…it is perfectly clear that its principle is utterly vicious. There is nothing so wild or absurd in John Law’s Theory of Money as this. His scheme of basing a paper currency upon land is sober sense compared to it. If for every debt the government incurs an equal amount of money is to be created, why, here we have the philosopher’s stone at once… But let us coolly consider the principle involved in this plan of issuing notes upon the security of the public debts. Stated in simple language, it is this: That the way to CREATE money is for the Government to BORROW money. That is to say, A lends B money on mortgage, and, on the security of the mortgage is allowed to create an equal amount of money to what he has already lent!! Granting that to an extent this may be done without any practical mischief, yet, as a general principle, what can be more palpably absurd.

Today, instead of manipulating the supply of money by printing up and exchanging notes for lands and mortgages, the Federal Reserve System, for example, creates additional bank reserves and check-able deposits in the economy by purchasing Treasury and mortgage securities from the public and the banks.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis. Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.

Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.