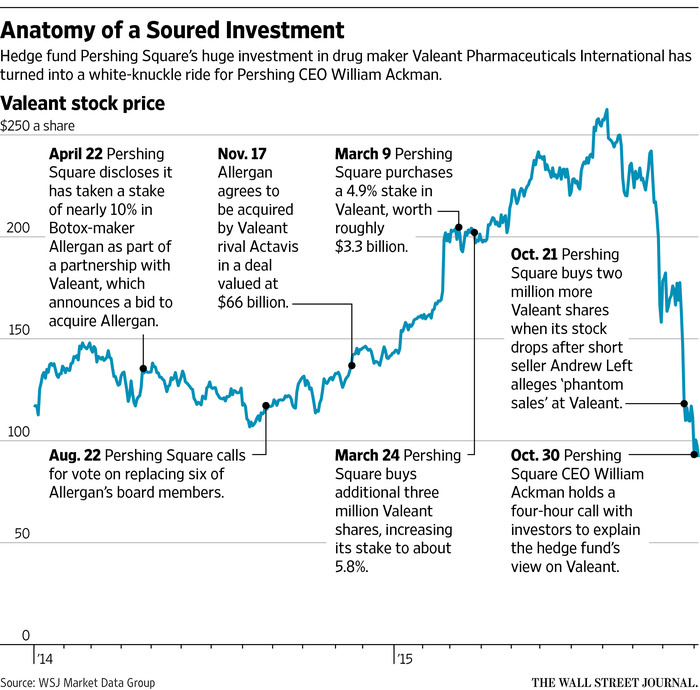

There is an ongoing battle over Valeant’s (VRX) valuation and business model between short-sellers and investors. This opportunity allows us to improve our analysis skills and understanding of business models. Also, how will Sequoia, an owner of over 20% of Valeant’s equity, handle their portfolio?

My first question is whether Valeant is a franchise with durable competitive advantages or a roll-up of commodity products dressed-up in a fancy industry (Pharma)? We should use this case to learn how experienced analysts present their opposing views.

First: What’s not to like? Valeant has rapid growth with huge profit margins? Of course, the PERFECT investment is a company that has high returns on capital and can constantly redeploy its capital at the same high returns. The classic case would be the early (pre-2000) history of Wal-Mart (WMT) as the high returns generated from its stores could be redeployed into new stores on the borders of their regions which had economies of scale in administration, advertising, and management costs per unit of sales. WMT did not have, for example, advantages in gross margins, but net profit margins. See WMT_50 Year SRC Chart.

What would be the source of Valeant’s high returns and competitive advantages?

Sequoia (a well-known value fund with an excellent long-term record) saw strong competitive advantages. See their recent investor transcript:

Sequoia-Fund-Transcript-2015-August Note the date of the transcript and the questions regarding Valeant concerning Philador and Sequoia’s 20% concentration.

Other investors (Charlie Munger, Citron) disagreed:

April 2, 2015 from www.fool.com

…..Recently, during a shareholders meeting for the Daily Journal Corporation, a newspaper where he serves as Chairman, Munger had this to say about Valeant Pharmaceuticals Intl Inc. (TSX:VRX)(NYSE:VRX): “Valeant is like ITT and Harold Geneen come back to life, only the guy is worse this time.”

What exactly does Munger mean by this?

A little history lesson

Who exactly was Harold Geneen? And what did he do at ITT that’s so infamous?

Geneen took over ITT Corp in 1959 when it was still mostly a telegraph and telephone company. After being blocked by the FCC in an attempt to buy the ABC television network in 1963, Geneen decided to diversify away from the company’s traditional business and completed more than 300 acquisitions during the decade in areas such as hotels, insurance, for-profit education, and the company that made Wonder Bread.

Geneen used cheap debt to finance these acquisitions, which later proved to be the company’s downfall. After Geneen’s retirement as CEO in 1977, subsequent CEOs spent much of the next two decades paying off the debt by selling most of Geneen’s acquisitions.

Is Valeant really comparable?

On the surface, Valeant looks like it could be pretty comparable to ITT. Since merging with Biovail in 2010, Valeant has made more than 30 different acquisitions, most of which were paid for with debt or by issuing shares.

Since the end of 2010, Valeant’s debt has skyrocketed from US$3.6 billion to US$15.3 billion. Shares outstanding have also gone up considerably from 196 million to 335 million. It’s obvious that Munger is onto something.

But on the other hand, I’m not sure Valeant is anywhere close to being as bad as ITT was. For one thing, all of the company’s acquisitions are at least in the same sector. ITT was buying up hotels and car dealerships, while Valeant is buying up pharmaceutical companies. Valeant’s efforts scale up a whole lot better than ITT’s ever did.

There’s also a bit of hypocrisy coming from Munger on this issue. Munger is actively involved in a company that does pretty much the same thing as ITT did back in the 1960s. Sure, Berkshire doesn’t use much debt or engage in hostile takeovers, but Berkshire and ITT have more in common than Munger is willing to admit. Both attempted to dominate the business world using a roll-up acquisition strategy; Buffett and Munger were just a little more patient with their plan.

But just because Munger exaggerates how bad Valeant’s acquisition spree has been doesn’t mean the stock is necessarily a buy at these levels. The company had earnings of just $2.67 per share in 2014, putting the stock at a P/E ratio of nearly 100 times. Yes, earnings are expected to grow substantially in 2015, but the outlook is simple. For the stock to continue performing, the company must continue to make acquisitions.

After making more than 30 acquisitions in just a few years, it’s hard to keep finding deals that will not only be big enough to make a difference, but will also prove to be good long-term buys. There’s so much pressure on management to keep buying that a serious misstep could be coming. If that happens, this hyped stock could head down in a hurry.

Although I don’t buy Munger’s alarmist concerns about Valeant, I agree with him on one thing. The stock just isn’t attractive at current levels.

—

A potential acquisition target, Allergan, Inc., points out its worries over Valeant’s business model. investor-presentation-may-27-2014-1 on VRX

Citron, a short-seller, attacks with a report: Valeant-Part-II-final-b. Valeant is another “Enron.” Use the search box on this blog and type in Enron and follow links to review that case. Enron never showed the profit margins that Valeant is currently showing. NEVER take another person’s statement on faith. Check it out for yourself.

Valeant today (October 26th, 2015) counters Citron and answers investors’ concerns with 10-26-15-Investor-presentation-Final4 Valeant and video presentation: http://ir.valeant.com/investor-relations/Presentations/default.aspxeep.

Ok, so what is Valeant worth? Can you make such an assessment? How do you think Mr. Market will weigh-in? If you owned a 20% stake in Valeant, how would you manage the position? What are the main issues to focus on?

This may be too difficult to analyze for many of us but we have or will have many documents and reports to provide insights. Remember that there are two sides to every narrative. Can we move closer to reality or the “truth”?

Note www.whalewisdom.com and type in VRX. What type of investor owns Valeant? Will momentum investors stick and stay?

Your comments welcome.

Sign up for Whitney Tilson’s emails on investing. Worth a look: leilajt2+investing@gmail.com